If you are familiar with derivative trading, you’ve likely come across with US30. From the name itself, US30 Index is associate with the Dow Jones Index that represent the top 30 largest companies in the US Stock Market.

However, while US30 is often referred to as the Dow Jones Index, it is, in fact, a financial trading instrument derived from the Dow Jones Industrial Average Index. It has gained popularity among individual investors due to its ease of trade.

Here, we’ll help you understand how US30 and the Dow Jones Index are related, how to trade it and what are the things we need to know for trading the US30.

1. What is US30 – The Dow Jones Index

US30, often referred to as US30 Cash, is a Contract for Differences derivatives based on the Chicago Mercantile Exchange (CME) Dow Jones industrial Average (DJIA) Futures.

The quote price of US30 is correlated with the price of CME’s Dow Jones Industrial Average Futures. The correlation between the quotation of the US30 Index and Dow Jones Futures as below:

US30 Price Quote = Dow Jones Futures near-month contract quote + Fair Value

The “near-month” contract refers to the closest Dow Jones Futures contract to the expiry, typically the most actively traded and closely tracks the Dow Jones Index.

2. Trading US30 – What are the advantages?

Dow Jones Futures are one of the most popular futures to trade in financial market, with many market participants involved in it, including individual investors. So, what do some investors choose to trade US30 instead?

Well, it’s because US30 CFDs offer a lower thresholds and higher flexibility in trading condition.

Here’s some quick comparison between the US30 CFD and CME’s Dow Jones Futures:

| US30 CFD | Dow Jones Futures (E-Mini) | |

|---|---|---|

| Contract Value | Index quote x 1 USD | Index quote x 0.5 USD |

| Minimum Trading Lots | 0.1 Lots | 1 Lot |

| Leverage | Up to 200x | Up to 20x |

| Contract Expiry | None | Quarterly |

| US30 Trading Hours | Taipei/Hong Kong Time: Monday 06:00 to Saturday 05:00 (Closed daily from 05:00 to 06:00) | |

1. Lower threshold to trade US30 CFD

Despite of the larger contract value compared to Dow Jones Futures, the threshold to trade US30 CFDs is lower due to higher leverage and smaller contract sizes available. Hence, the minimum margin required to trade US30 Cash is only 1/50 of Dow Jones Futures.

Now, let’s assume that the real-time price for Dow Jones Index is 33,280, the margin required to trade 1 lot of US30 CFDs is as below:

Margin of 1 lot of US30 = 32,800 x 1 USD / 200 Leverage = 164 USD

Besides, US30 allows to trading at a minimum of 0.1 Lots, which means that only US$ 16.4 margin is required to start trading US30 CFD.

2. No expiry on US30

Dow Jones futures are quarterly contracts that require settlement at the end of each quarter. For traders looking to roll over their positions, they need to re-establish positions on the new contract themselves.

In contrast, US30 has no expiration date, allowing traders to hold positions indefinitely without the need for rollovers.”

3. US30 does not have complex margin requirements

With Dow Jones futures, the margin is divided into initial margin and maintenance margin. Moreover, the margin requirements differ for intraday and overnight trades.

However, with US30, there’s only a single margin requirement calculated based on the contract value only at the time of establishing the position.

10x Boosting Your Brand

Lorem ipsum dolor sit amet, consectetur adipiscing elit

3. Trading US30 – What are the key considerations?

Comparing Dow Jones futures, the US30 indefinitely have its advantages, so does it have any disadvantages? Well, its primary drawback might lie in the over-the-counter trading:

- Dow Jones futures are traded on exchanges, with standardized quotes and higher broker security.

- US30 is traded over-the-counter, lacking standardized quotes, and the level of security largely depends on the chosen broker.

Despite not having standardized quotes, it doesn’t necessarily mean discrepancies in price quote. Most of the time, quotes from different brokers are very close as they are quoted based on the price of the near-month contract of Dow Jones futures.

In terms of security, there might be significant differences among various CFD brokers. Choosing a well-established broker with regulatory licenses from major European or American financial authorities tends to be safer.

In reality, US30 remains a niche investment product, while Dow Jones futures are mainstream and one of the most actively traded futures. Institutions and professional investors often choose to trade Dow Jones futures, while US30 is more suitable for beginners and retail investors with smaller capital.

4. US30 Index Specification

After understanding the basic knowledge of US30, it is important for investors interested in trading the US30 to have a grasp on some US30 contract specification. Here’s some key points to look at:

1. US30 Contract Value

US30 is quoted in USD. Although different brokers may have variations in the size of a contract (1 lot), the majority of them follow the contract specification as below:

The contract value for 1 lot of US30 = Index Quote x 1 USD

For instance, if the current US30 is quoted at 32,800 index point, the contract value for one lot of US30 is 32,800 USD.

2. US30 Margin & Leverage

Margin is the deposit required to open a US30 trade and is determined by the contract value and the trading leverage. Different brokers may offer varying leverage, typically ranging from 50 to 500 times.

200x leverage is commonly seen. For example, with a quote of 32,800, the margin to buy one lot of US30 using 200x leverage would be:

Margin for 1 lot of US30 = Contract value ÷ Leverage = 32,800 / 200 = 164 USD.

Furthermore, many brokers offer mini-lot contracts, enabling trading as low as 0.1 lots, which means one can start trading US30 with just 16.4 USD.

3. US30 Points and Point value

The value per point refers to the monetary value corresponding to a one-point change in price, and it correlates directly with the trading lot size:

| Trading Lot Size | US30 Value per Point |

|---|---|

| 0.1 lots | 0.1 USD |

| 1 lot | 1 USD |

| 5 lots | 5 USD |

4. US30 Spread

Points are the units used to measure price movements. US30 quotes typically extend to two decimal places. 1 point represents a change of 1 in the first decimal place of the quote. For instance, a move from 32,800.25 to 32,801.55 indicates a price change of 1.3 points.

The spread is the cost of trading US30, representing the difference between the buying and selling prices. In the given quote, the spread for US30 is 1.25 points. If we go long 1 lot of US30 at this spread and assume no change in the quote before immediately closing the position, this trade would result in a loss of 1.25 USD.

How do we understand this? When initiating a long position, the entry price is determined by the ASK price (32,807.70), and when closing the position, it’s based on the BID price (32,806.45).

Therefore, if closed immediately after opening, the profit/loss would be 32,806.45 – 32,807.70 = -1.25 USD, indicating a loss equivalent to the spread.

Explore more about US30

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

5. Trading US30 – Example

Below is a complete trading case study demonstrating how to utilize US30 to trade fluctuations in the Dow Jones Index price:

Trading Scenario

The Dow Jones Index is at 33,000. We anticipate a potential decline to 32,000. Hence, we initiate a short trade using US30, aiming to profit from the downward market.

Opening Position

Initial capital: $1,000

Account leverage: 200x

Short position size: 1 lot

Opening quote: 33,000.00 / 33,001.25

Entry price: 33,000.00

Trading margin: $165

Take profit price: 32,000.00

Account leverage: 200x

Short position size: 1 lot

Opening quote: 33,000.00 / 33,001.25

Entry price: 33,000.00

Trading margin: $165

Take profit price: 32,000.00

Immediately after initiating the trade, due to the spread cost, the trade incurs an immediate loss of $1.25. At this point, the account equity is ($1,000 – $1.25) = $998.75. Of this, $165 is the trading margin and cannot be utilized until the position is closed. The available margin is ($998.75 – $165) = $833.75, which can be used to cover losses and open new positions.

Profit Calculation

Assuming the short position is executed, and US30 price declines as expected to 32,000, triggering the take profit.

Profit from trade = 33,000 – 32,000 = $1,000

Loss Calculation

Suppose instead of the anticipated decline, the US30 price rises to 33,200 after initiating the short position. At this point, a reassessment leads to a decision to close with a stop loss.

Loss from trade = 33,000 – 32,200 = $200

6. How to Trade US30 – Best Broker for US30

After thoroughly understanding the trading rules, the next step is to select a brokerage firm to open an account for trading US30. As mentioned in the previous section, the choice of broker is crucial for the security of trading US30. Below are brief introductions to three brokerage firms with higher security ratings.

1. ThinkMarkets

Rating: 5 Stars

| Regulatory Licenses: | UK FCA, Australian ASIC, Japan FSA, New Zealand FMA, Cyprus CYSEC, South Africa FSCA |

|---|---|

| Trading Platform: | MT4, MT5, ThinkTrader |

| US30 Leverage: | 200x |

| US30 Spread: | 1.25 Points |

ThinkMarkets is a well-known low-cost brokerage firm holding multiple mainstream financial licenses. Its advantage in US30 trading lies in its low spread, with trading costs of only $1.25 per hand during active periods.

2. IG

Rating: 4.5 Stars

| Regulatory Licenses: | US NFA, UK FCA, Australian ASIC, Japan FSA, Swiss FINMA, Singapore MAS |

|---|---|

| Trading Platform: | MT4, L2 Trader |

| US30 Leverage: | 200x |

| US30 Spread: | 2.4 points |

3. Exness

Rating: 4 Stars

| Regulatory Licenses: | UK FCA, Cyprus CYSEC |

|---|---|

| Trading Platform: | MT4, MT5 |

| US30 Leverage: | 400x |

| US30 Spread: | 2.6 points |

Exness is renowned for its high-leverage trading conditions and offers a 400x leverage for the US30 product.

7. Frequently Asked Question - US30

1. Relation between US30 and Forex Trading:

US30 is often mentioned alongside forex trading because many forex brokers offer US30 trading. Hence, many traders learn about US30 through their forex trading experience.

2. How to Trade US30 on MT4/MT5 Platform:

The MT4/MT5 platforms are popular for forex trading, offered by many forex and CFD brokers. To trade US30 on MT4/MT5, follow these steps:

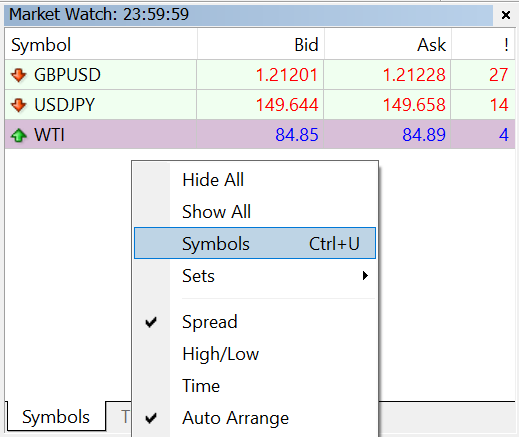

3. How to add US30 to the MT4/MT5 platform.

- Double-click the quote window at the top left corner of the platform and select “Symbols.”

- In the Symbols window, locate and expand Indices, then double-click on US30 to activate it.

- Afterwards, you’ll be able to see US30 in the Market Watch window and proceed with trading.