The Federal Reserve, widely recognized as the most influential central bank globally, deeply affects financial markets with every decision it takes. Its monetary policy doesn’t just affect the US market but also across the global financial markets.

In this following article, we are going to further explains the duties of the Federal Reserve, its organisation structures, monetary policy and a comprehensive understanding of the Federal Reserve.

1. What is the Federal Reserve – Central Bank of the United States

The Federal Reserve, or commonly known as “The Fed”, is the central bank of the United States. Its primary functions, beyond the widely recognized monetary policy adjustments (raise or cut interest rates), also encompass five key responsibilities aimed at fostering stability within the U.S. economy and financial system:

- Formulating monetary policy to achieve full employment and stable prices.

- Promoting stability within the financial system and managing systemic risks.

- Fostering the soundness of private financial institutions.

- Facilitating secure and efficient payment and settlement systems.

- Advancing consumer protection and community development.

Independency is the most significant characteristic of the Federal Reserve (Fed). Although its Chairman and Board members are nominated by the President and confirmed by Congress, its funding comes entirely from operational profits rather than government subsidies.

The policy-making of the Fed is entirely independent, free from influence by the U.S. government and officials, with its decisions devoid of political considerations.

2. The Organizational Structure of Federal Reserve

The Federal Reserve is comprised of three key entities:

2.1) Board of Governors:

Consisting of seven members, including the Chairman, all nominees are appointed by the U.S. President and confirmed by the Senate. Members of the Board are directly accountable to Congress, representing public interests. They oversee the operations and supervise the 12 regional Federal Reserve Banks.

The Board of Governors controls two of the three major monetary policy tools of the Federal Reserve: the discount rate (or bank rate) and reserve requirements. The most crucial tool, open market operations (pertaining to interest rate decisions), is determined by the Federal Open Market Committee.

2.2) Regional Federal Reserve Banks:

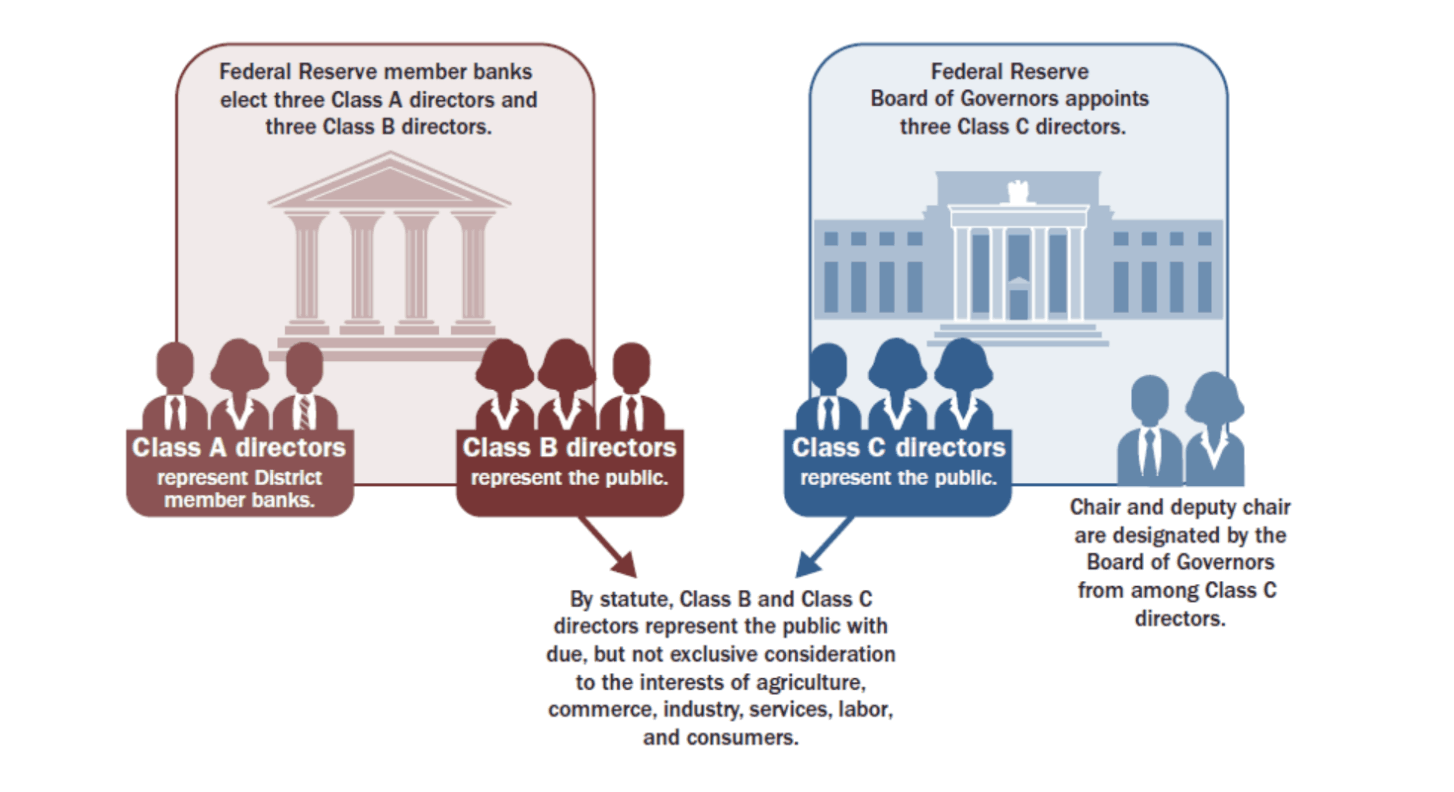

The directors of the Federal Reserve Banks are divided into three classes, each consisting of three members:

Divided into 12 regional banks, responsible for executing various policies within their respective regions. The governance structure of these regional banks reflects a mix and balance between public interests and private banks.

3.3) Federal Open Market Committee (FOMC):

The Federal Open Market Committee, commonly known as “FOMC”, is the central bank institution most closely watched by global financial markets and is responsible for formulating the United States’ monetary policy. It comprises 12 voting members who regularly convene to discuss and decide upon the country’s monetary and interest rate policies.

FOMC meetings constitute the most pivotal events in global financial markets, exerting long-term and far-reaching effects on the global economy and financial marke

Readers interested in understanding the details of FOMC meetings can refer to articles explaining what the FOMC meeting entails for further learning.

3. Chairman of the Federal Reserve

The Chairman of the Federal Reserve holds a pivotal role within the Fed and serves as the head of the Federal Reserve Board. Nominated by the U.S. President and confirmed by the Senate, the Fed Chair’s term spans four years and can be reappointed once.

Jerome H. Powell is the current Chairman of the Federal Reserve. He was nominated by former President Trump in 2018 for his first term and was reappointed in 2022, commencing his second term, which will conclude in May 2026. Speeches and public remarks made by the Fed Chairman can significantly impact financial markets, as market participants interpret them to gauge the Fed’s monetary policy direction.

4. Monetary Policy Tools by The Fed

The Federal Reserve employs various tools to influence the trends in the U.S. and global financial markets through its set benchmark interest rates and monetary policies.

Apart from the widely known open market operations, the Federal Reserve currently utilizes multiple tools to help achieve its target benchmark interest rates:

1. Open Market Operations (OMOs)

This primary monetary policy tool involves the Fed buying or selling securities in the open market to adjust reserve supplies, thereby controlling the federal funds rate within a targeted range.

2. Discount Rate (Bank Rate)

Controlled by the Board of Governors, it provides lending to commercial banks and depository institutions against collateral, influencing the rates for such borrowings.

3. Reserve Requirements

Banks are mandated to maintain a certain percentage of their deposits in reserve accounts at the Federal Reserve. While these requirements were significant until 2020, they have been largely eliminated, although banks may still hold funds in their Federal Reserve accounts, for which the Fed pays interest.

4. Interest on Reserves (IOR):

The Fed pays interest to banks on funds held in reserve accounts, affecting banks’ willingness to lend excess reserves to other banks.

5. Overnight Reverse Repurchase Agreement (ON RRP)

Involves the Fed selling securities to eligible counterparties (banks) with an agreement to repurchase them the following day, controlling the federal funds rate within the targeted range.

6. Term Deposit Facility (TDF)

Similar to individual term deposits, banks can place funds in term deposits with Federal Reserve Banks, influencing rates by reducing reserve supplies.

7. Central Bank Liquidity Swaps

The Fed maintains swap arrangements with other central banks (e.g., Bank of Canada, Bank of England) to provide liquidity in their currencies against USD during periods of stress.

8. Foreign and International Monetary Authorities (FIMA) Repo Facility

Allows eligible foreign central banks and international financial regulatory authorities to temporarily exchange their U.S. Treasury holdings for USD.

9. Standing Repo Facility (SRF)

Similar to overnight reverse repurchase agreements, this tool allows the Fed to purchase securities from eligible counterparties with an agreement to resell them the following day, providing short-term funding directly through the Fed.

These tools together form the arsenal used by the Federal Reserve to influence monetary policy and manage economic conditions.

5. How the Federal Reserve Affects Financial Market

The Federal Reserve, or more accurately, its monetary policy, exerts a significant influence on global financial markets. The specific impact can be a complex process, but put simply, the basic logic is as follow:

- When the Federal Reserve implements loose monetary policy, there’s abundant market liquidity and lower borrowing costs, which typically lead to rising trends in global stock markets, commodities, and similar markets.

- Conversely, when the Federal Reserve tightens monetary policy, market liquidity decreases, borrowing costs rise, and global stock markets, commodities, and other markets often experience declines.

6. Is the Federal Reserve a private institution?

Due to its profitability and policy independence, some perceive the Federal Reserve as a private institution. However, in reality, it doesn’t belong to any individual or entity; it serves the public interest in the United States and is accountable to the U.S. Congress.

Despite the Federal Reserve’s substantial annual net income (primarily from interest on policy bonds purchased through open market operations), after deducting expenses, all surplus income is remitted to the U.S. Treasury.

As mentioned in the previous section outlining the Federal Reserve’s organizational structure, both the Federal Reserve and its regional reserve banks’ principal officials are nominated by the President and confirmed by the Senate, representing the public interest in the United States.